- FREE BUDGET SPREADSHEET FOR FREE

- FREE BUDGET SPREADSHEET PDF

- FREE BUDGET SPREADSHEET SOFTWARE

- FREE BUDGET SPREADSHEET CODE

- FREE BUDGET SPREADSHEET DOWNLOAD

The steps below are universal to all templates you download from the internet, as built-in Excel templates already show up on your Welcome screen upon launching the application.

Once you have Microsoft Excel installed on your computer, using a template is as easy as one-two-three.

FREE BUDGET SPREADSHEET FOR FREE

FREE BUDGET SPREADSHEET SOFTWARE

The templates below guide you in using the software to effectively track your expenses without having to hire a professional or spend money on premium services. Stay patient and count on those tools that can make your life easier without even lifting a finger.Select reviewed more than a dozen expense tracker MS Excel templates and found the top choices for monitoring your spending.Īll the templates below are free to use, easy to customize, and incredibly user-friendly. Remember that tracking your money may be quite challenging – especially at first. What does the conversion process look like? It’s a cakewalk, really: you select your budget spreadsheet, wait until it gets converted, and then download the file once it’s ready. Also, all data will be automatically wiped out from servers once the conversion is complete.

FREE BUDGET SPREADSHEET CODE

All files are encrypted, which means they are concealed by turning them into a code (so that no one can read them).

It works with any OS, including Windows, Mac, and Linux

FREE BUDGET SPREADSHEET PDF

It will turn your budget spreadsheet into a PDF file sooner than you make yourself a cup of tea. It’s also smart to have a PDF version at hand (especially if you need to print it, view it on multiple devices, or email it to your spouse without the loss of formatting).Īn easy, time-saving way to do it is to use an Online PDF Converter.

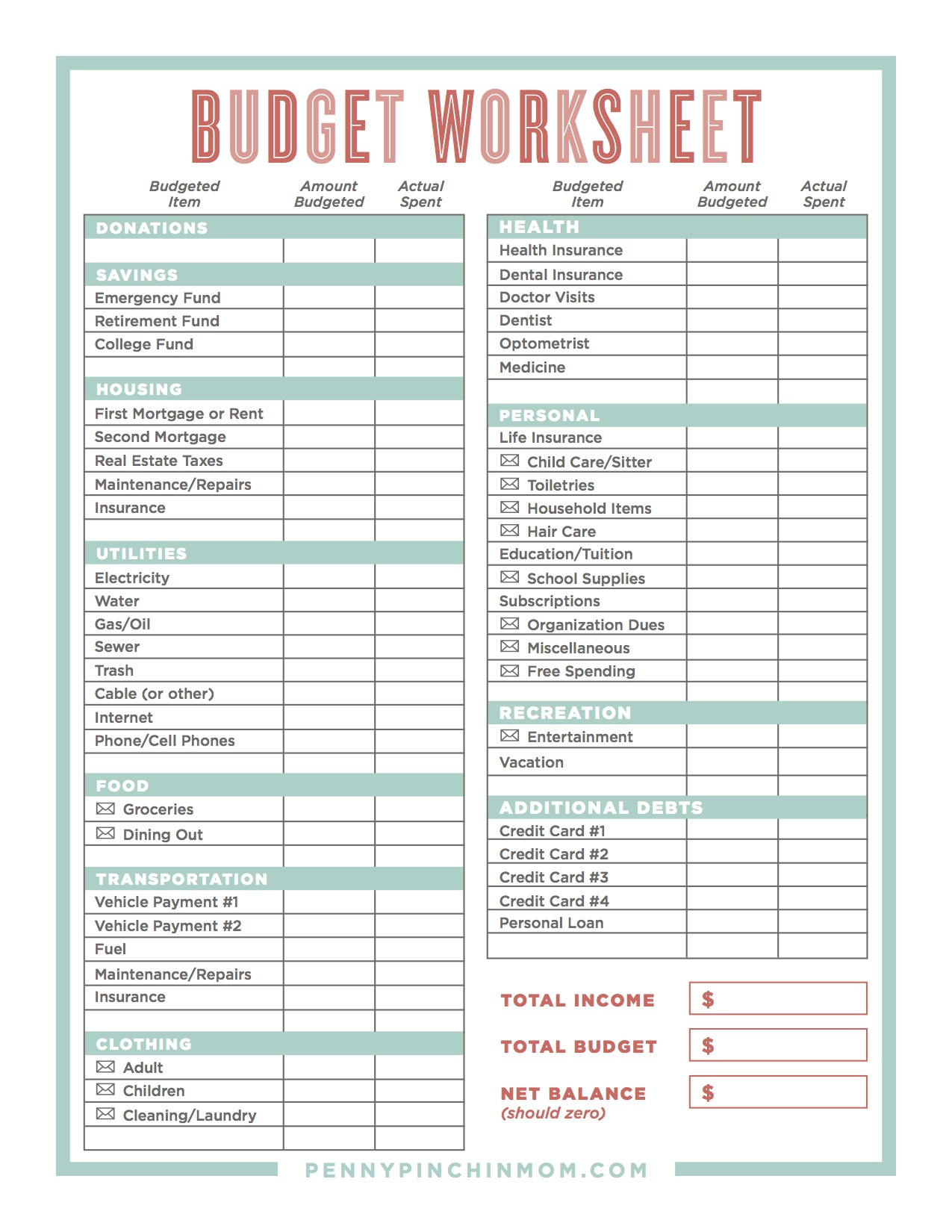

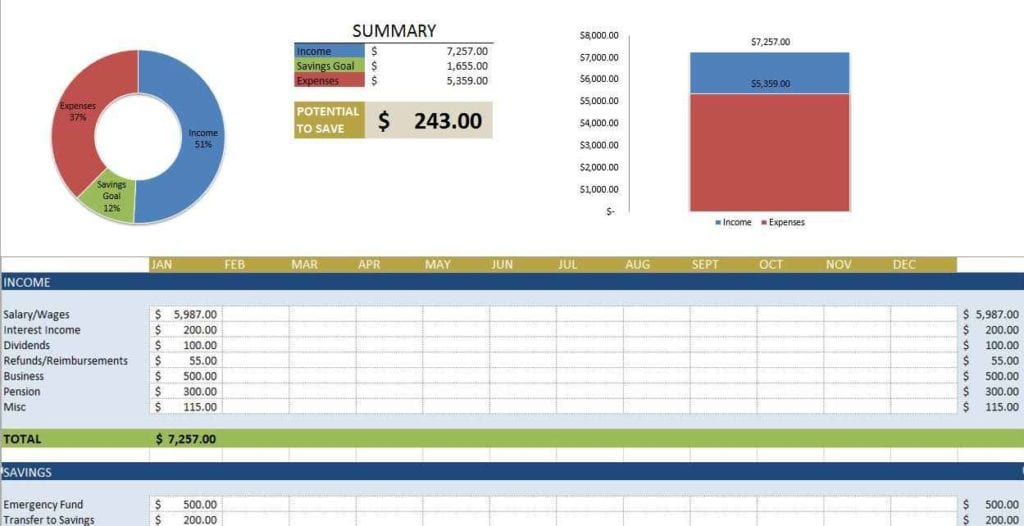

To open your spreadsheets conveniently and modify them, you can try downloadable open-source office suites (such as Apache OpenOffice, LibreOffice, etc.) or use an online editor (Google Sheets). So whatever type of costs you have, you’ll find a dedicated place to put it. Personal Monthly Budget is very comprehensive – with numerous sections and multiple categories within each section. It will pinpoint where it’s wise to make changes. This spreadsheet focuses on the difference between your projected earnings and costs versus your actual income and costs. Personal monthly budget by My Money Shrugged This spreadsheet also shows if you’re close to an ideal income allocation that’s often suggested by financial experts. One thing you’ll instantly notice – in this spreadsheet, all the categories are very neatly stacked. The spreadsheet will calculate how much “available” money you should have in your hands by the end of the month (perhaps to save, or to put towards debt). You’ll enter your income and the monthly amounts of various expenses. Sure, there’s no one-size-fits-all approach to money management – however, this one is frequently recommended by experts, so if you’re hesitating where to start, it might be worth a shot.įree budget spreadsheet by Money Under 30 It shows which chunk of your income should go to your “needs” (50%), “wants” (30%), and “savings/investments” (20%). This budget planner is based on the well-known 50/30/20 breakdown. The planner will add everything up and show how your spending compares to the 50/30/20 budget. You fill in the fields about your income and expenses. Here are some budget planners you may like. “Which budget planning template should I pick?” The best part is that you don’t have to bend over backward to get started – a great deal of work has already been done for you. There are multiple spreadsheets online, many of which are completely free to use. They can help you get on board with budgeting without jarring stress or boredom – even if you’re not a huge fan of math. A simple (yet effective!) idea is to begin using budgeting templates. Here’s the good news: to start, you don’t necessarily need any fancy equipment or sophisticated advice from financial consultants. Maybe you constantly worry about your debt and find yourself wondering, “When will I be able to enjoy the finer things in life?” It’s been your favorite New Year’s resolution for years – and also impossible to keep, because you’re never sure where to begin. Ever since you can remember, you wanted to get your financial situation under control. Perhaps you can recognize yourself in this not-so-thrilling picture. Create a budget spreadsheet without MS Excel and turn it into a PDF

0 kommentar(er)

0 kommentar(er)